georgia property tax relief

But capping the annual value increase in property assessments in the name of property tax relief is bad policy for Georgia and no answer to property tax woes. About the Company Georgia Property Tax Relief CuraDebt is a company that provides debt relief from Hollywood Florida.

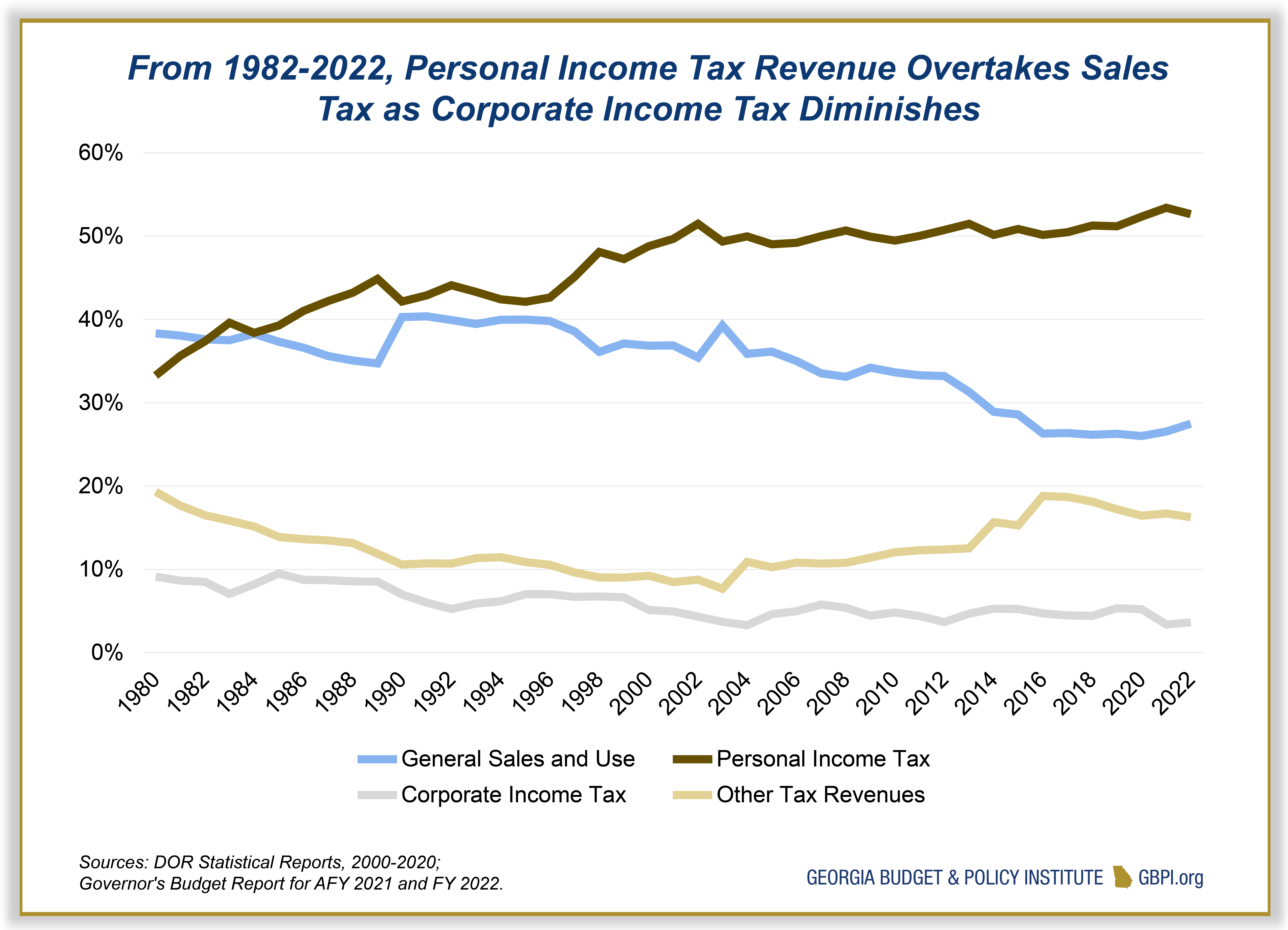

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Heres a brief overview in the table below.

. ONE-TIME DIRECT PAYMENTS WORTH 600 SENT OUT TO OREGONIANS IN NEED. This organization is not BBB accredited. Assessment caps artificially suppress the taxable value of property that does not change ownership.

Any questions pertaining to tax exemptions at the local level should be asked to and answered by your County Tax Commissioners office. This legislation allows for an additional refund of income taxes from 2020 due to the state. Georgia Property Tax Relief Inc.

The amount is 93356 during FY 2022 per 38 USC. For more information on tax exemptions visit dorgeorgiagov call 404-724-7000 contact your county tax commissioners office or consult a tax professional. There are 3 director records in this entity.

We lower the property tax burden for parcels all across Georgia and the Atlanta area. See BBB rating reviews complaints more. The 18 states are sending up to 850 to single filers in rebates with.

Check if you qualify. Get the Help You Need from Top Tax Relief Companies. The agent name for this entity is.

Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. Tax Return Preparation in Duluth GA.

Corona Virus Tax Relief FAQs. Georgia Property Tax Relief Inc. If a federal extension is filed Georgia will accept it and if one is.

Specializes in reducing property taxes for Atlanta area property owners- representing our clients at the Board of Equalization and working with proven results to lower commercial property taxes as well as residential property taxes. The value of the property in excess of this exemption remains taxable. Ad Based On Circumstances You May Already Qualify For Tax Relief.

Call or email us for a chart showing savings for most Metro Counties. This break can drop annual property taxes to well below 2000yr for most seniors. On the bright side the Georgia General Assembly has been successful in offering property tax incentives which provide significant tax relief for agricultural lands forest lands environmentally sensitive areas and residential transitional properties which have saved landowners millions of dollars in tax relief.

There are several property tax exemptions in Georgia and most are pointed towards senior citizens and service members. On the bright side the Georgia General Assembly has been successful in offering property tax incentives which provide significant tax relief for agricultural lands forest lands environmentally sensitive areas and residential transitional properties which have saved landowners millions of dollars in tax relief. Cobb Cherokee and Forsyth Counties are among those providing an exemption from the school tax portion of property taxes for those using their GA home as their primary residence.

Provide Tax Relief To Individuals and Families Through Convenient Referrals. As a result owners of similar properties often pay tremendously disparate property taxes. We lower the property tax burden for parcels all across Georgia and the Atlanta area.

We can help you significantly reduce the taxes on your Georgia home or commercial property. There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens. Our staff has a proven record of substantially reducing property taxes for residential and commercial clients.

GEORGIA PROPERTY TAX RELIEF INCORPORATED was registered on May 28 2004 as a domestic profit corporation type with the address 3435 BUFORD HWY STE B DULUTH GA 30096. The company id for this entity is 0433670. Our staff has a proven record of substantially reducing property taxes for residential and commercial clients.

This initiative is a result of House Bill 1302 which the Georgia General Assembly recently passed and Governor Kemp signed into law. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. Ad Do You Owe Georgia State DOR tax and need a monthly payment plan.

Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence. May 11 2022. You must request an extension by July 15 2020.

To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year. Specializes in reducing property taxes for Atlanta area property owners- representing our clients at the Board of Equalization and working with proven results to lower commercial property taxes as well as residential property taxes. Ad You Dont Have to Face the IRS Alone.

The GDVS can only verify the status of a. The Department of Revenue announced today that it will begin issuing special one-time tax refunds this week. It was established in 2000 and has been an active part of the American Fair Credit Council the US Chamber of Commerce and accredited by the International Association of Professional Debt Arbitrators.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Types of Property Tax Exemptions in Georgia.

2022 State Tax Reform State Tax Relief Rebate Checks

The Georgia Homestead Exemption Decoded Brian M Douglas

2021 Property Tax Bills Sent Out Cobb County Georgia

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Taxes In Georgia Country Income Corporate Vat More

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Exemptions To Property Taxes Pickens County Georgia Government

Georgia Property Tax Liens Breyer Home Buyers

What Is A Homestead Exemption And How Does It Work Lendingtree

Dekalb County Ga Property Tax Calculator Smartasset

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

5 Property Tax Deductions In Georgia For You Excalibur

Homestead Exemptions Georgia 2019 Cut Your Property Tax Bill Youtube

Property Tax Homestead Exemptions Itep

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute